SAVE TODAY SO YOUR BUSINESS IS PREPARED FOR TOMORROW

Make sure excess cash is doing its part to grow your business. Earn competitive interest on what you set aside, and access funds as needed.

See More DetailsBenefits You’ll Love

- Earn competitive interest

- Maintain liquidity with access to funds

- $10 quarterly service charge

- Business digital banking services

- Simplified saving solution

- Build a cash cushion for the future

- Competitive interest on minimum daily balance of $500 or more

- Avoid a $10 quarterly service charge by maintaining a $500 average daily balance

- Digital banking services, including:

- Online banking

- Mobile banking

- eStatements

- $100 minimum opening deposit

{{ savings-goal }}

Important information about procedures for opening a new account:

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask you for your name, address, date of birth, and other information that will allow us to identify you. We will also ask to see your driver's license and other identifying documents.

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total interest earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Take Us With You

Spend less time banking and more time building your business.

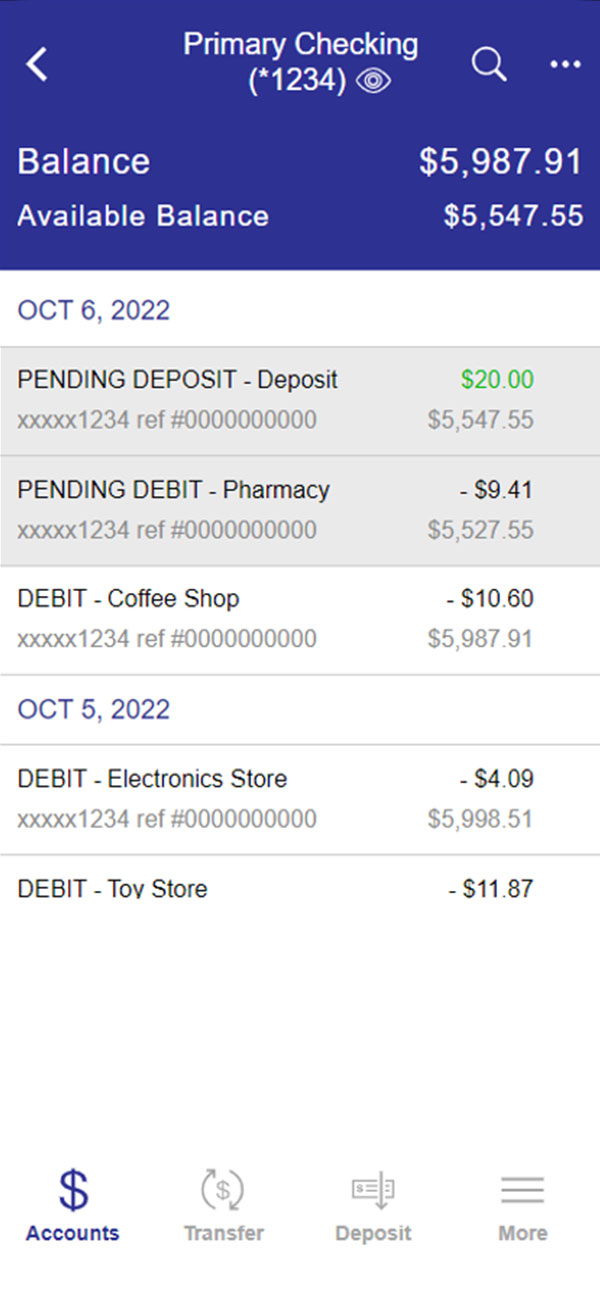

Manage accounts whenever, wherever, on whatever device you want.

Sign, scan, and send deposits directly through the GBank app.

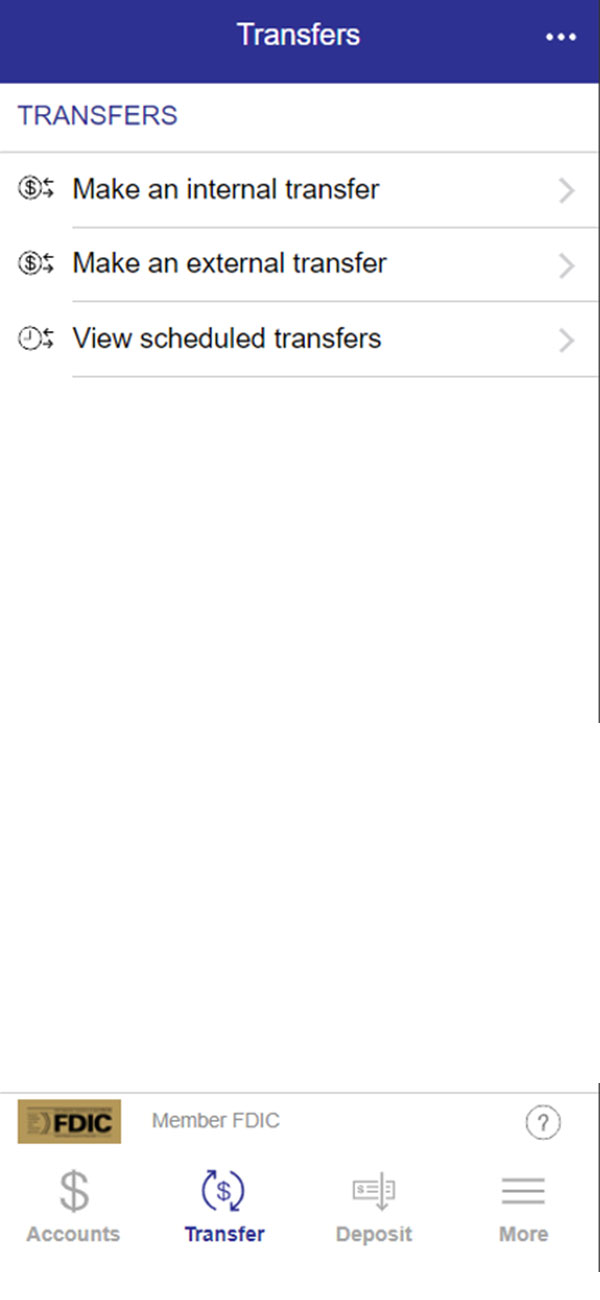

Move your money from here to there in just a few clicks or taps.